income tax rates 2022 ireland

VAT and Sales Tax Rates in Ireland for 2022. Ireland VAT Rate 2100.

Corporation Tax Europe 2021 Statista

In the final phase of March and April.

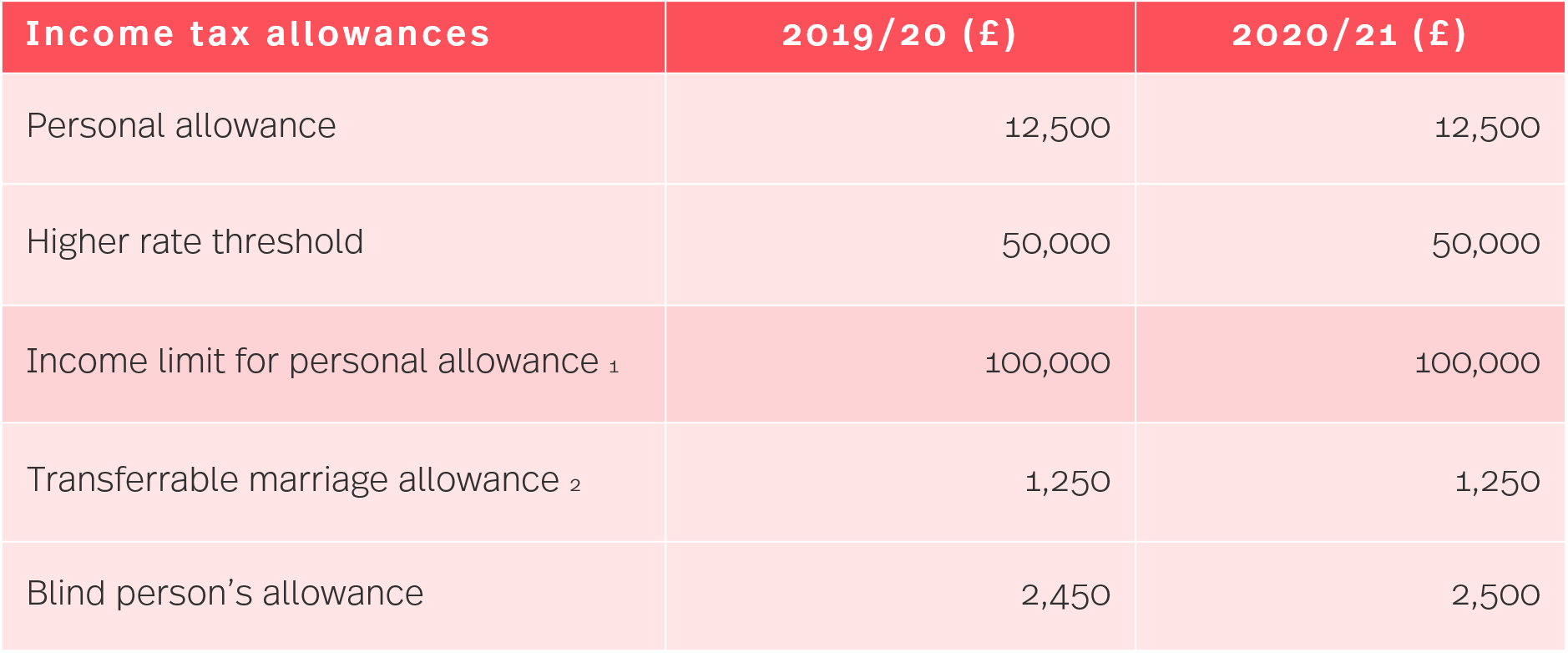

. The rate of income tax will stay the same but tax credits will be increased. Irelands 2022 property tax deadline just days away with exception for some. There were no changes.

1 day agoTax on wages earned by workers in Ireland increased by 03 in 2021 according to a report from the OECD. Personal income tax rates. Rate bands and tax reliefs for the tax year 2022 and.

There are seven federal income tax rates in 2022. Capital gains rate. Variations can arise due to rounding.

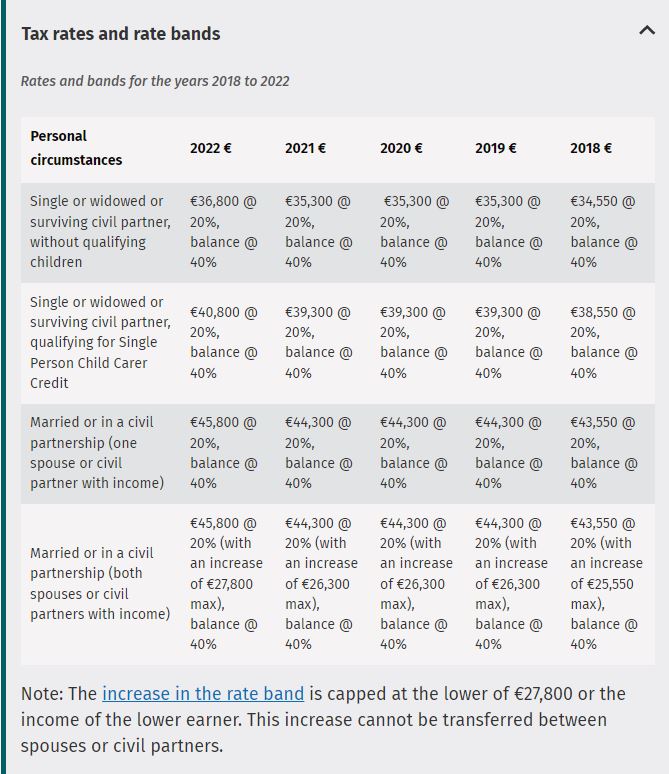

The personal income tax system in Ireland is a progressive tax system. Due to these income tax changes a single. 2022 EUR Tax at 20.

Ad A high quality low cost individual tax return service. Effective Income Tax Rates in Ireland 1997-2022. Total of income tax including USC levies and PRSI as a total income.

Get a quick quote today. By Doug Connolly MNE Tax. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your.

An additional 17 million is allocated for once-off COVID-19 business supports in 2022. The OECDs tax wedge measures the burden of tax on earned income. Please note the results are approximate.

Resident companies are taxable in Ireland on their worldwide profits including gains. Use our interactive calculator to help you estimate your tax position for the year ahead. The weekly income threshold for the higher PRSI rate will also rise from 398 to 410.

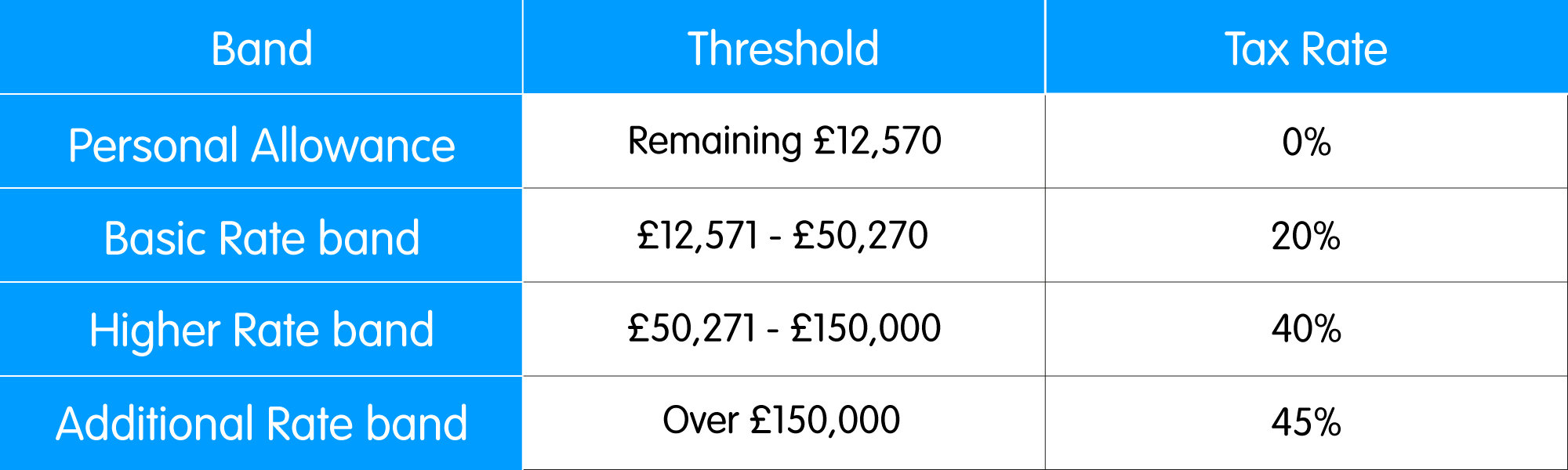

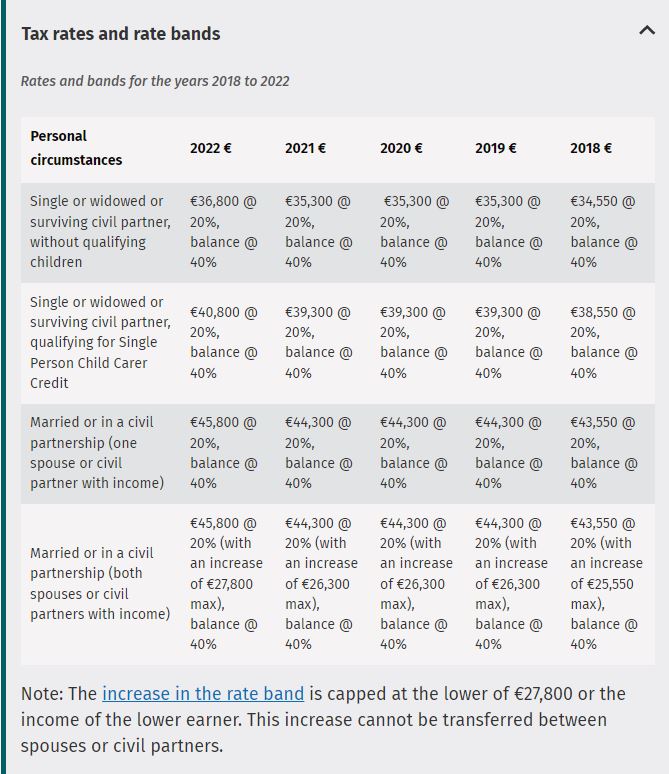

These income tax bands apply to England Wales and Northern Ireland for the 2022-23 2021-22 and 2020-21 tax years. Ad A high quality low cost individual tax return service. Single and widowed person.

Get a quick quote today. The first part of your income up to a certain amount is taxed at 20. 1 day agoTue May 24 2022.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. About 21 tax on a 100 purchase. Find out more in our guide to.

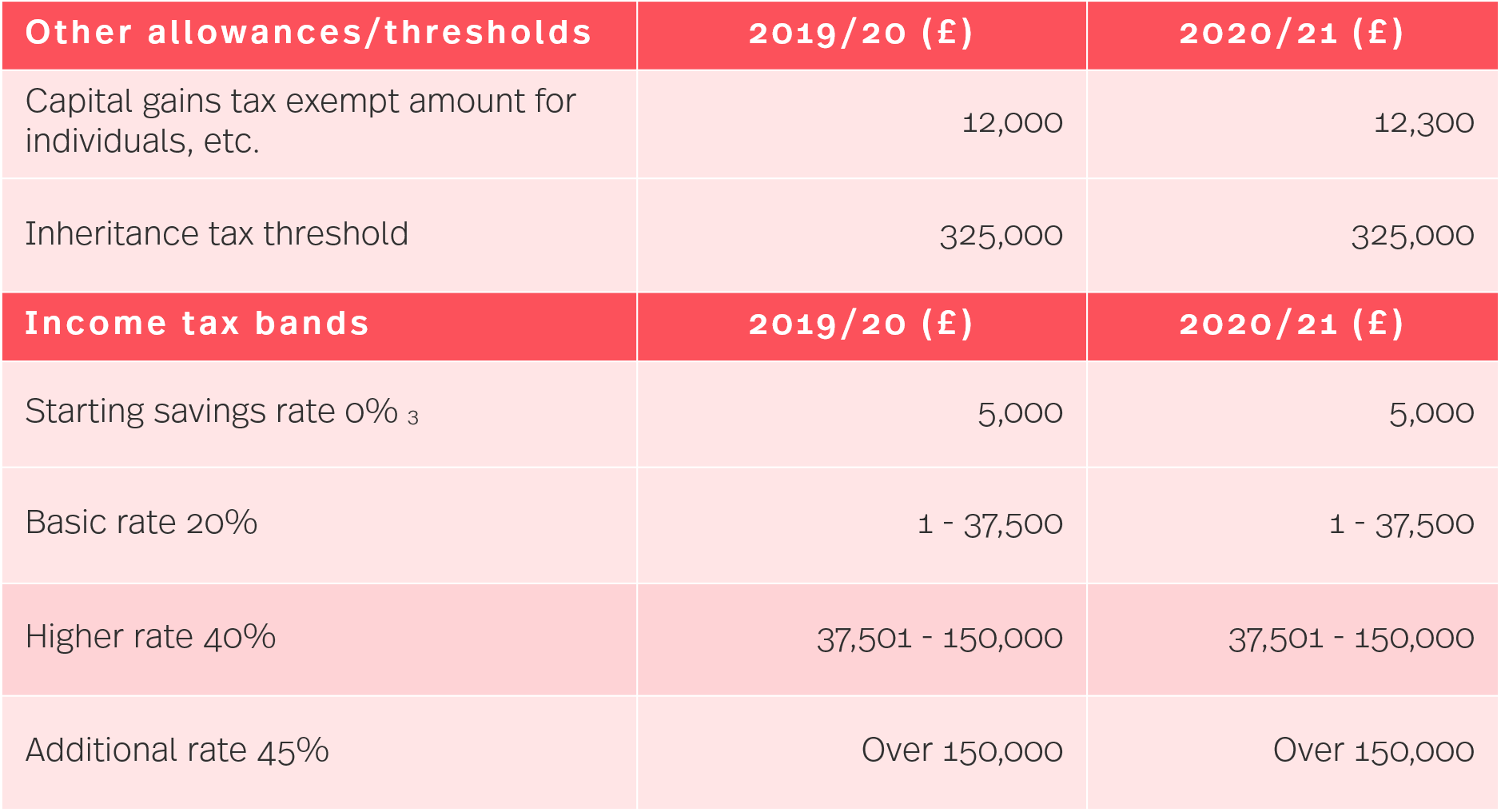

Income up to 36800. 2021 Rate 2022 Rate Income up to 05 Income up to 05 Income above 20 Income above 20 Note 1. Ireland Annual Salary After Tax Calculator 2022.

Personal income tax rates changed At 20 first At 40 Single person increased 36800 Balance Married couplecivil partnership one income increased 45800 Balance. This that the OECD average of 754 per cent due to the lower point at which the higher rate of income tax kicks in in Ireland. The income tax changes for 2022 are an important part of the Governments response to supporting citizens with this challenge.

The rates of Car Tax in Ireland have not been changed for a few years but in Budget 2021 there were some adjustments to motor tax on some cars. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. That you are an.

The Personal Income Tax Rate in Ireland stands at 48 percent. This page shows the tables that show the various tax band and rates together with tax reliefs for the current year and previous four years. Listed below are the current VAT rates in Ireland in 2022.

Ireland has a bracketed income tax system with two income tax brackets ranging from a low of. 2019-2020 State Income Tax Rates Sales Tax Rates and Tax Laws. Income taxes in Scotland are different.

Value Added Tax VAT is a tax t hat is levied on the sale of most goods and services in Ireland. Aggregate income for USC purposes does. Personal Income Tax Rate in Ireland averaged 4565 percent from 1995 until 2020 reaching an all time high of 48 percent in.

We help file income tax returns for individuals across Ireland. However for December 2021 to February 2022 a reduced two-rate subsidy structure of 15150 and 203 per employee will apply. We help file income tax returns for individuals across Ireland.

The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line. Tax Bracket yearly earnings Tax Rate 0 - 36400. This is known as the standard rate of tax and.

To complete Irelands transposition. Non-resident companies are subject to Irish. The percentage that you pay depends on the amount of your income.

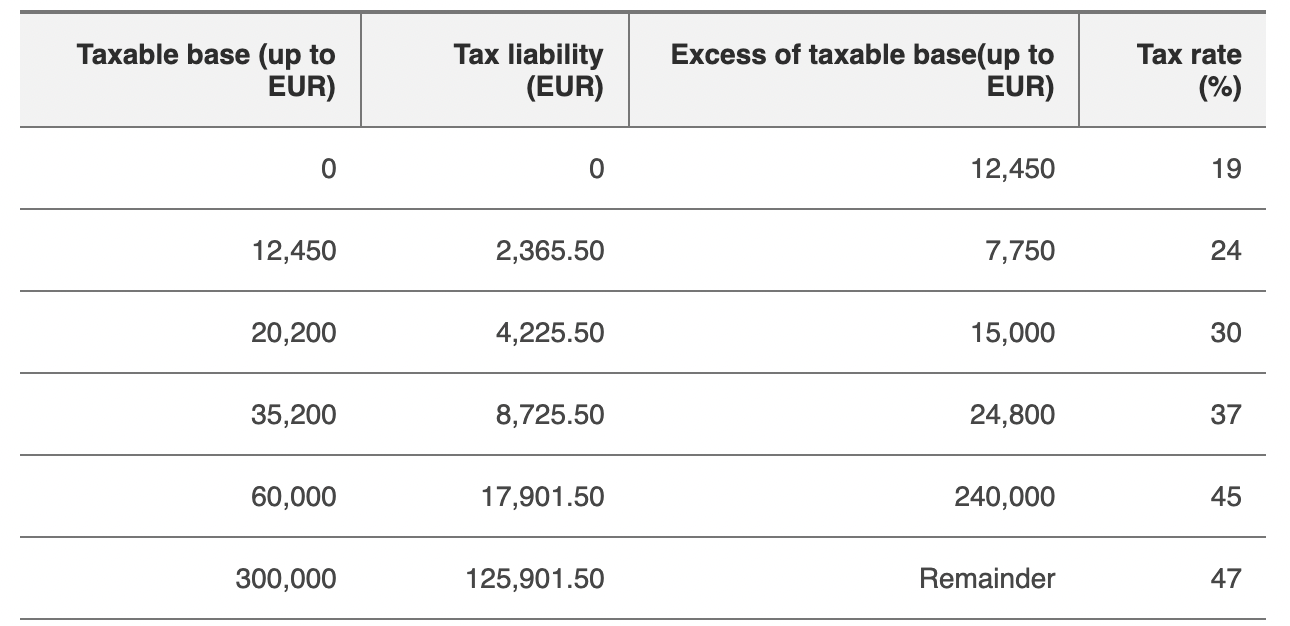

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

How To Calculate Foreigner S Income Tax In China China Admissions

Hmrc Tax Rates And Allowances For 2020 21 Simmons Simmons

How To Calculate Foreigner S Income Tax In China China Admissions

Comparing Irish Income Taxation Rates With Other Eu Member States Public Policy

Paying Tax In Ireland What You Need To Know

2022 Corporate Tax Rates In Europe Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

70 000 After Tax 2021 Income Tax Uk

How To Calculate Income Tax In Excel

How Do Taxes Affect Income Inequality Tax Policy Center

Tax In Spain Issues You Need To Be Aware Of Axis Finance Com

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

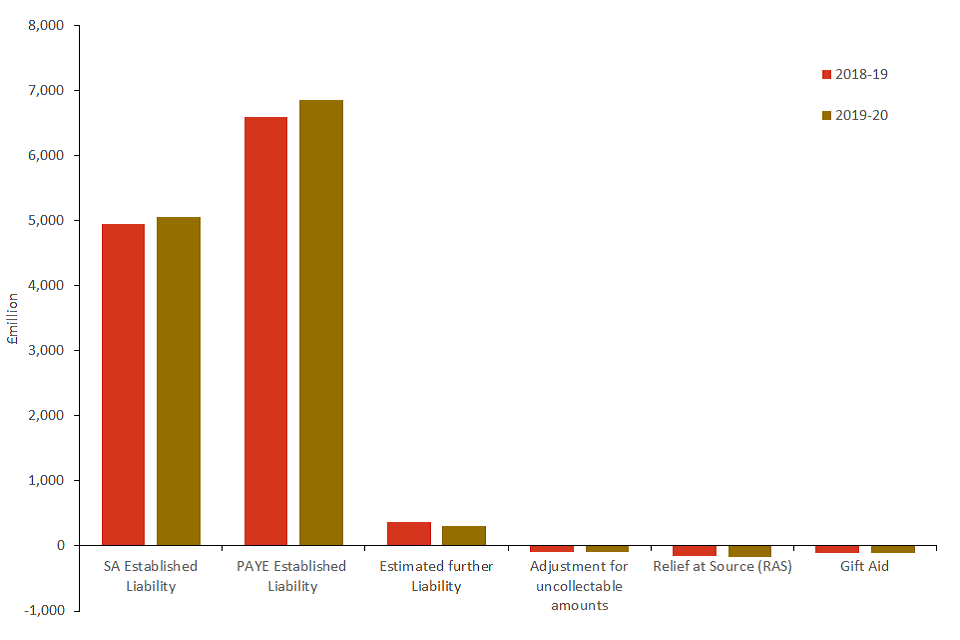

Scottish Income Tax Outturn Statistics 2019 To 2020 Gov Uk

Paying Tax In Ireland What You Need To Know